What is Postal Life Insurance Scheme, An individual’s life insurance is a crucial financial tool. Having life insurance helps shield your spouse and kids from any catastrophic financial losses that may arise from your untimely death. In addition to other financial organisations, Post Offices are essential in providing convenient life insurance coverage.

Contents

What Is a Postal Life Insurance Scheme?

Postal Life Insurance (PLI), a life insurance program offered by India Post, was first started on February 1, 1884. This program was first presented as a welfare program for Post Office employees. But as of right now, this feature is also available to workers in state and federal government agencies, defence troops, paramilitary forces, educational institutions, etc.

PLI insurance supports the policyholder’s family financially in the case of their passing. You are able to insure your spouse and children as well with the affordable PLI insurance rates. India Post provides a range of PLI packages to meet the demands of each individual client. Relative to the low premiums paid, Postal Life Insurance’s programs produce significant returns because it is one of the most respected and well-established life insurers in India.

Also Read: PM Scholarship Scheme, Nebsit Council, Typingspeedtestonline, digitizeindiagovin.com

Features of Postal Life Insurance Policy

Make sure you understand the following benefits and what Postal Life Insurance policies entail before choosing a PLI.

- In exchange for a relatively cheap payment, PLI provides a high return on your insurance and bonus rates.

- With your PLI schemes, you can designate a nominee and modify candidate details with ease over the course of the policy.

- Should you be a PLI holder, you may obtain a loan through the postal department secured by the policy.

- As long as you follow the rules and procedures that the department specifies, you can convert your PLI plan to an Endowment Assurance Policy.

- The Post Office offers duplicate insurance documents, which can be obtained easily, in the event that your original is destroyed, torn, or lost.

- India Post provides a passbook function, which is updated on a regular basis, so you can easily trace the premium payments you make for your PLI.

Postal Life Insurance Eligibility

The following is a list of companies whose workers can enrol in PLI plans:

- Central and state government organisations.

- Paramilitary forces.

- Defence personnel.

- Public Sector Undertakings (PSUs).

- Banks.

- Educational institutions.

- Local bodies.

- Professionals, such as doctors, MBAs, engineers, chartered accountants, MBAs, lawyers, etc.

- Employees of companies listed with the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

- Department of Posts.

Postal Life Insurance Scheme Bonus

A nearly annual fluctuation occurs in the incentive rates for Postal Life Insurance plans. The bonus rates for the 2023–2024 fiscal year that you will get from your PLI are displayed in the table below:

| Postal Life Insurance Plan | Bonus Rate as per PLI Scheme |

| Whole Life Assurance or Suraksha Scheme | Rs. 76 per 1000 Sum Assured (SA) each year |

| Endowment Assurance or Santosh Scheme | Rs.52 per 1000 SA each year |

| Anticipated Endowment Assurance or Sumangal Scheme | Rs.48 per 1000 SA each year |

| Convertible Whole Life Assurance or Suvidha Scheme | Rs.76 per 1000 SA each year (if Whole Life Insurance is not converted to Endowment Assurance). A bonus of endowment assurance shall be paid during conversion. |

| Joint Life Assurance or Yugal Suraksha Scheme | Rs.52 per 1000 SA each year |

| Children Policy or Bal Jeevan Bima | Rs.52 per 1000 SA each year |

Postal Life Insurance Benefits

- Being able to offer substantial benefits (in the form of incentives) in return for low premiums makes it one of the most economical solutions for life insurance.

- A copy policy bond can be easily manufactured in case the original policy is lost, destroyed, or damaged.

- At any point during the policy’s term, policyholders have the option to change the preferred beneficiaries listed for post office insurance products.

- Additionally, the policy can be modified to switch from whole life insurance to endowment assurance, and the amount assured can be adjusted in compliance with preset procedures.

- Policyholders may be able to take out loans against their insurance after at least three years of coverage have passed.

Postal Life Insurance Calculator

Obtaining a preliminary assessment of the premium and the returns before making an investment in a Postal Life Insurance plan is always a good idea for everyone. A PLI calculator that is accessible online is usually a wise choice in this regard. It’s simple to predict how much premium you will pay and what your returns will be after a given period of time by using the Postal Life Insurance calculator.

Postal Life Insurance Login

You must first register on India Post’s Customer Portal if you are a new user of the Postal Life Insurance program. Here’s a step-by-step tutorial to help you register:

- Step 1: Go to India Post’s official website.

- Step 2: Choose Retail after clicking Register.

- Step 3: Click Register after entering the necessary information.

- Step 4: After that, you will receive an activation link for your account through the email address you registered with.

- Step 5: To activate the account, click the activation link that was emailed to your email address within 48 hours.

Also Read: Swadhar Greh Scheme, ssorajasthanidlogin.com, indnewsupdates.com, Mobilenumbertrackeronline

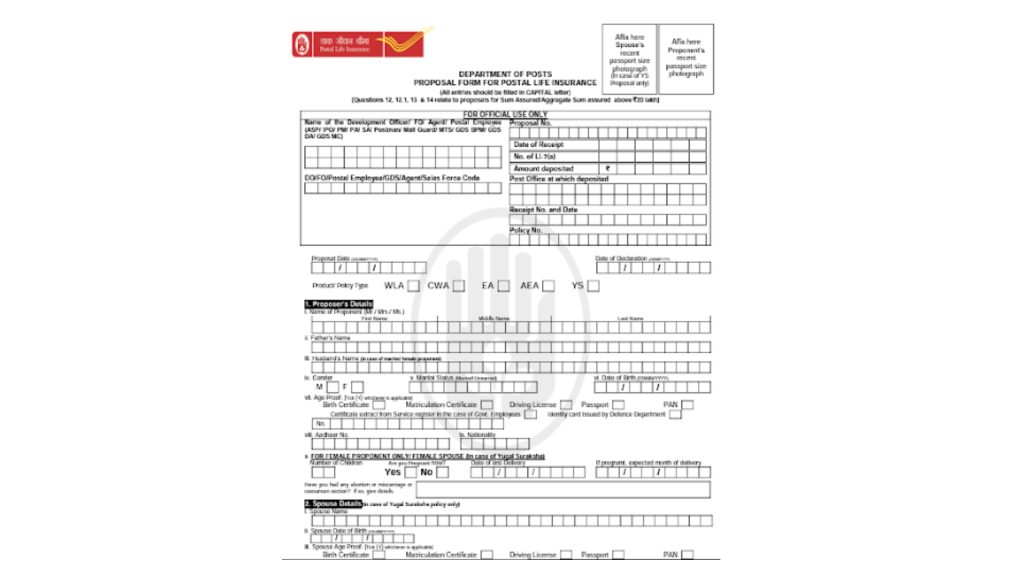

Postal Life Insurance Forms

You have the option to obtain the Postal Life Insurance program application form through online or offline means. To download the form online, take these steps:

- Step 1: Go to India Post’s official website.

- Step 2: Pick Postal Life Insurance as your selection.

- Step 3: Choose Download Forms and Documents from the drop-down menu under the “Miscellaneous” category.

- Step 4: Choose the PLI Proposal Form form from the list of forms that appear.

- Now, completing the form and submitting it in accordance with your needs is simple.

- If you would prefer to obtain the PLI application form offline, go to the Post Office that is closest to you and request one.

- This is a sample application form for a postal life insurance program.

Postal Life Insurance Online Payment

There are several ways to pay for Postal Life Insurance online. Below is a thorough explanation of the various online payment options for PLI plans:

- Online portal or smartphone app: You may use the Indian Post app, also known as the Indian Post Payments Bank or IPPB app, to pay your premium if you have a policy with the Postal Life Insurance scheme. To finish your online payment, you can alternatively go to India Post’s website.

- Making Use of Net Banking: You can use the net banking procedure to finish your premium payment online. Simply choose the net banking option when choosing a payment method.

- Utilising an App for UPI: Alternatively, you can choose to use the UPI apps you already have, such as PhonePe, Google Pay, or Paytm to finish your PLI online payment.

Premium Table for Convertible Whole Life Assurance

| Age at Entry | Monthly Premium Payable for the first 5 years and then ceases if the option is not exercised at the age of 60 (Premium in Rs) | If the option to convert the policy into an endowment assurance that matures at the age of 50, 55, or 58 is selected, a monthly premium will be payable after the first 5 years (Premium in Rs) | ||

| 50 Years | 55 Years | 58 Years | ||

| 19 | 7 | 14 | 11 | 10 |

| 20 | 7 | 15 | 11 | 11 |

| 21 | 8 | 15 | 12 | 11 |

| 22 | 8 | 16 | 12 | 11 |

| 23 | 8 | 16 | 13 | 11 |

| 24 | 8 | 18 | 13 | 12 |

| 25 | 9 | 19 | 15 | 12 |

| 26 | 9 | 19 | 15 | 13 |

| 27 | 9 | 21 | 16 | 13 |

| 28 | 9 | 22 | 16 | 15 |

| 29 | 10 | 23 | 17 | 15 |

| 30 | 10 | 25 | 19 | 16 |

| 31 | 11 | 26 | 20 | 17 |

| 32 | 11 | 30 | 20 | 17 |

| 33 | 12 | 31 | 21 | 18 |

| 34 | 12 | 35 | 22 | 19 |

| 35 | 13 | 39 | 24 | 20 |

| 36 | 13 | 43 | 27 | 22 |

| 37 | 14 | 47 | 28 | 23 |

| 38 | 15 | 54 | 31 | 24 |

| 39 | 16 | 64 | 33 | 25 |

| 40 | 16 | 77 | 36 | 27 |

| 41 | 17 | 96 | 40 | 30 |

| 42 | 18 | 126 | 46 | 33 |

| 43 | 19 | 188 | 52 | 36 |

| 44 | 21 | 364 | 58 | 39 |

| 45 | 22 | – | 69 | 42 |

| 46 | 24 | – | 85 | 47 |

| 47 | 26 | – | 113 | 55 |

| 48 | 28 | – | 166 | 64 |

| 49 | 30 | – | 319 | 78 |

| 50 | 33 | – | – | 99 |

Also Read: EPF Pension Scheme, Onlinereferjobs, yojanaforall.com, shaladarpanportalgov.com,

Conclusion

The Postal Life Insurance program offers a number of features and advantages. Purchasing life insurance becomes the most crucial financial strategy if you want to set up a sizeable sum of money for the future of you and your family. To invest your hard-earned money safely and suitably, please read over the terms and conditions of PLI policies and look into the many plans that are offered.

Faq’s

Q. Is PLI superior to LIC?

Ans: It is usually wiser to invest in PLI rather than LIC if you meet the requirements for a Postal Life Insurance plan. Because of its higher returns, lower premiums, and extra bonus benefits on the policy, PLI is regarded as being superior to LIC.

Q. Which PLI plan is the best?

Ans: The Suraksha Postal Life Insurance scheme, also known as Whole Life Assurance, offers the highest amount of assurance and the highest age eligibility to issue a policy, making it the finest option out of all of them.

@PAY