Mudra Yojana Scheme, Under the Pradhan Mantri Mudra Yojana, banks are lending money to the nation’s entrepreneurs at favourable interest rates. Our nation’s prime minister, Shri Narendra Modi, introduced the Pradhan Mantri Mudra Yojana on April 8, 2015. Applicants for the Pradhan Mantri Mudra Yojana must be willing to take out a bank loan. We will cover every detail in this post today, including the application process, eligibility requirements, documentation, and registration procedure.

The Pradhan Mantri Mudra Yojana of the Central Government is a significant move to providing financial help to Indian entrepreneurs. This plan offers unguaranteed loans to entrepreneurs up to a maximum of 10 lakhs. This program is especially intended for individuals who want to start and expand their own enterprises. The loan’s original five-year duration has been replaced with a 10-year payback term, and no guarantee is needed. The Pradhan Mantri Mudra Yojana offers loans to entrepreneurs across various age groups, categorised as child, adolescent, and youth. In addition to giving millions of people job opportunities, this program is significantly advancing national growth.

Also Read: PLI Scheme India, shaladarpanportalgov.com, yojanaforall.com, Onlinereferjobs

Contents

Mudra Yojana Scheme-Overview

| Name of the scheme | Pradhan Mantri Mudra Yojana |

| Started by | PM Narendra Modi |

| Date of the scheme | Year 2015 |

| Agency | Micro Units Development and Refinance Agency |

| Beneficiaries | To empower small and medium entrepreneurs |

| Target | For startups |

| Loan amount | 50 thousand to 10 lakh |

| Mode of application | Offline |

| Official website | https://www.mudra.org.in/ |

Pradhanmantri Mudra Yojana Objective

The Indian government has introduced a number of programs to help those who are experiencing financial hardship. The Indian government offers a loan program that helps people who wish to launch their own businesses by providing them with financial support. In addition, the Pradhan Mantri Mudra Yojana fosters their independence and helps them become self-sufficient. By giving the recipients the required capital, this program encourages individuals to launch a business and improves their financial situation.

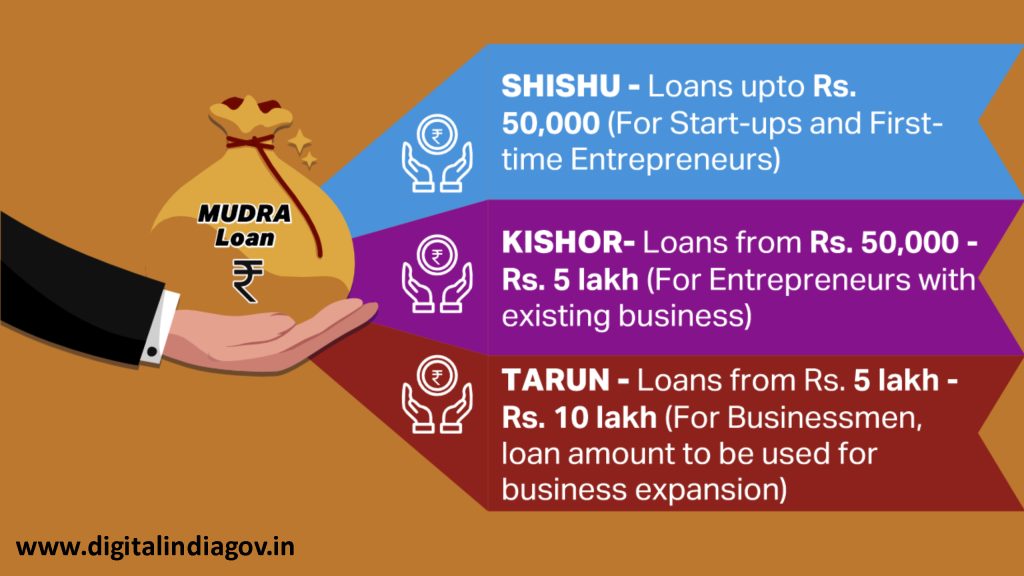

Pradhanmantri Mudra Yojana Types

- Shishu Loan – The bank will give a Shishu loan of up to Rs 50 thousand.

- Kishor Loan – The bank will give a loan of Rs 50 thousand to 5 lakh in Kishore Loan.

- Tarun Loan – The bank will give a Tarun loan of Rs 5 lakh to 10 lakh.

Benefits of the Pradhan Mantri Mudra Yojana

- The Pradhan Mantri Mudra Yojana, which would assist them in obtaining bank loans, will be beneficial to the nation’s business owners. They can take out loans at discounted rates thanks to this plan.

- Notwithstanding bank rejection, entrepreneurs are able to obtain up to a 10 lakh rupee loan through the Central Government’s Pradhan Mantri Mudra Yojana.

- This program will allow business owners to obtain loans without requiring any collateral. They will be able to launch new ventures with financial security thanks to this.

- Through this program, the government will lend money to the citizens, giving them the chance to launch their own business and move closer to being self-sufficient.

Pradhanmantri Mudra Yojana Eligibility and Documents

- Applicant should not be less than 18 years

- Aadhar Card

- Applicant’s Identification Card

- Driving License

- PAN Card

- Voter ID Card

- Balance Sheet of previous years

- Sales Tax Return

- Income Tax Return

- Correspondence Address

- Mobile Number

- Bank Account

Also Read: SANKALP Scheme, Mobilenumbertrackeronline, indnewsupdates.com, ssorajasthanidlogin.com

PM Mudra Yojana Features

- India’s prime minister, Shri Narendra Modi, introduced the Pradhan Mantri Mudra Yojana on April 8, 2015.

- Small and micro-groups which might be neither corporate nor within the agricultural area are eligible for loans up to ₹10 lahks beneath this scheme.

- The Pradhan Mantri Mudra Yojana gives mudra loans.

- Industrial banks, small financing banks, and non-banking funding organizations offer these loans.

- Shishu, Kishor, and Yuva are eligible for loans under the plan.

- There are loans reachable in Shishu loan up to ₹50,000.

- Mortgage amounts presented via Kishor loan range from ₹50,000 to ₹50 lakh.

- It is possible to approve a Tarun loan for between ₹50,000 and ₹10 lakh.

Pradhanmantri Mudra Yojana Activities

This loan is being provided in order to boost employment and income under the Pradhan Mantri Mudra Yojana. This loan may be used for the following purposes:

- Business Loan for vendors, dealers, shopkeepers and other service enterprises.

- Loan for Working Capital using Mudra Card

- Financing for Equipment to Micro Businesses

- Transport Vehicle Loan solely for commercial use.

- Agricultural Relations: Financing for the production of non-agricultural income (such as fishing, poultry farming, and beekeeping).

- Tractors and tellers with two wheels can only be borrowed by enterprises.

- Agricultural Relations: Financing for the production of non-agricultural income (such as fishing, poultry farming, and beekeeping).

- Two-wheeled tractors and tellers are specifically for business use only.

Pradhanmantri Mudra Yojana Card

The Mudra card gives its customers a type of bank-issued debit card that makes it simple for them to take out cash from their bank accounts. This card functions similarly to an ATM card and can be used to obtain a loan from the bank in your name up to the specified limit. With the Mudra card, business finance can be satisfied and it can be used digitally. In addition, recipients can meet their financial needs by using their Mudra card to make payments at point-of-sale terminals and withdraw cash from any ATM in the nation.

Pradhanmantri Mudra Yojana Online Apply

To initiate your business venture, you can apply for a bank loan by doing the following:

- To apply for this plan, the applicant must first get an application form from the relevant bank.

- Subsequently, you must fill out the application form with the requested information (name, address, phone number, Aadhar card number, etc.), attach the necessary paperwork, and send it to the relevant bank.

- After the bank official has reviewed your application and all supporting documentation, the loan amount will be transferred to your bank account within a month.

- In this manner, your application will be finished, and the loan amount will enable you to launch your own business.

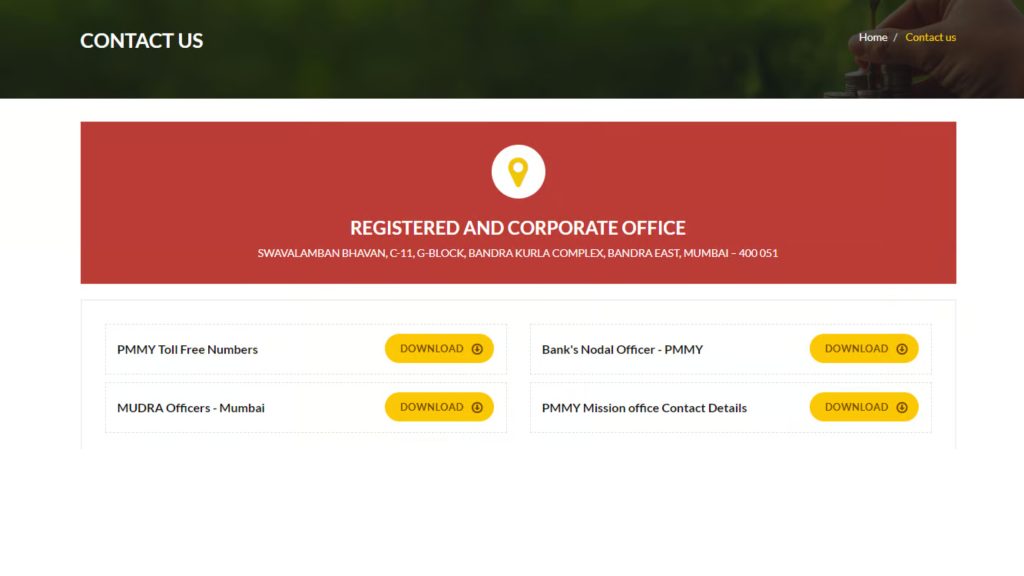

Pradhanmantri Mudra Yojana Toll-Free Number

- You should first go to the Pradhan Mantri Mudra Yojana’s reputable internet site.

- The principal display will now appear in front of you.

- On the principal page, you have to pick the Touch Us link.

- You now need to open a new web page and click on the download hyperlink this is listed next to the Emmy toll-loose quantity.

- You may download all of the state-specific toll numbers as quickly as you click on this link.

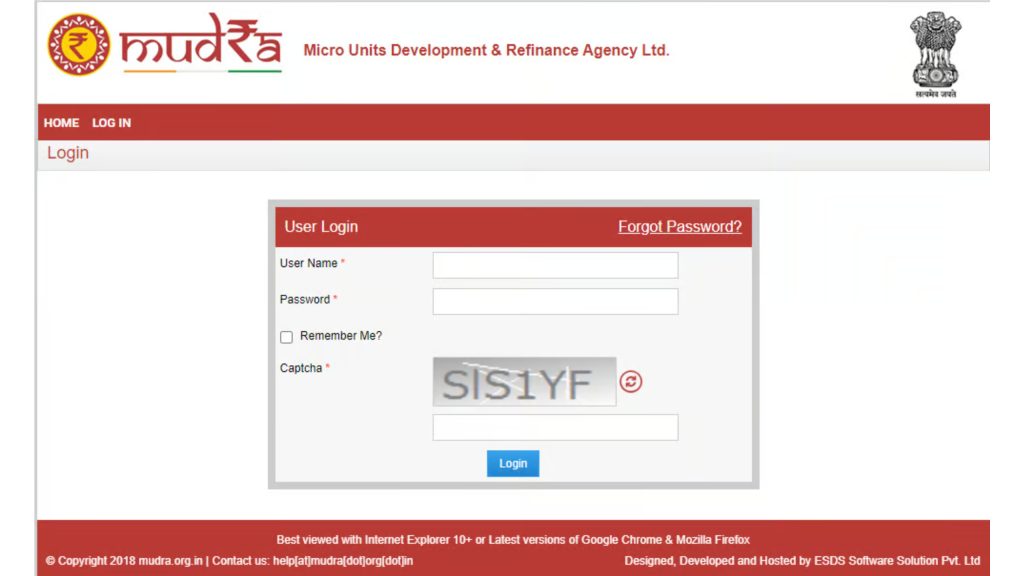

Pradhanmantri Mudra Yojana Login Process

- You must first go to the Pradhan Mantri Mudra Yojana’s legitimate internet site.

- The primary screen will now appear in front of you.

- Then you want to click on the Emmy portal hyperlink.

- The login web page will now appear, requiring you to go into your password, username, and captcha.

- You may be capable of getting the right of entry to the PMMY portal through doing this.

Also Read: PM Scholarship Scheme, digitizeindiagovin.com, Typingspeedtestonline, Nebsit Council

Conclusion

This article demonstrated the significance of the Pradhan Mantri Mudra Loan Yojana, a government initiative that offers financial support to individuals aspiring to become entrepreneurs. This program’s benefits are being used by young people without jobs and entrepreneurs, and applying for a loan under it is an easy process. Banks have already given millions of people loans under this program, giving them a means of becoming self-sufficient. Therefore, this scheme should be availed at the correct moment and this initiative of the government should be supported.

Faq’s

Q. What is the interest rate on a Rs 50,000 Mudra loan?

Ans: Kishor Mudra Yojana-Loans up to Rs 5 lakh are approved under this plan. Based on your credit history and the plan rules, the interest rate starts at 8.60%.

Q. How many days does it take to approve a Mudra loan?

Ans: Loans are often approved by NBFCs and banks in the public and private sectors in 7–10 working days.

@PAY