LTC Cash Voucher Scheme:- The finance minister of our country is launching yet another initiative to support all federal and state government employees.The LTC Cash Voucher Scheme for 2023 is the name of the scheme. We will give you all the details about the opportunity so you can submit an application without any problems or inquiries.We will go over the goals of the LTC cash voucher program for 2020 as well as any other associated procedures with you all. We will also go over with you the detailed process that we must adhere to in order to apply for the new opportunity that the nation’s finance minister has announced.

Contents

LTC Cash Voucher Scheme 2023

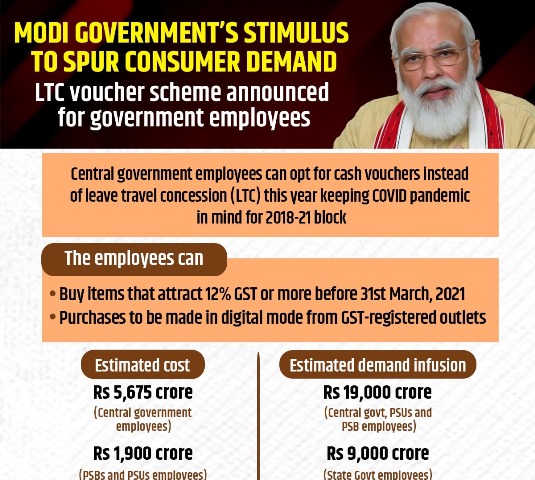

Employees of the federal and state governments would get cash vouchers under the LTC Cash Voucher Scheme, which was approved by the government in 2023. The employees will receive these coupons, which they can redeem for a variety of things as specified by the governing bodies behind the initiative. The goods that employees can buy will have a GST of about 12%.Workers are only allowed to buy non-food products.Only employees who make digital purchases from businesses that have registered for GST may use this cash discount.

Insurance Premium

As everyone is aware, the government unveiled the LTC Cash Voucher Scheme on October 12, 2020. In order to get benefits under this system, beneficiaries must purchase goods and services with a GST of at least 12%. Under this policy, the government has chosen to loosen the cash encashment requirements. Employees of the central government are now eligible to participate in this program and pay an insurance premium for policies acquired between October 12, 2020, and March 31, 2021.

- The government would refund the employee for the premium they paid, and they would also be eligible for tax benefits.

- The intention behind the introduction of the LTC cash voucher program was to boost customer demand.

- In order to receive the benefit, employees must provide a self-attested photocopy of their bills rather than the original bills when purchasing products like cars, as stated by the ministry.

- An employee may use this program to receive the cash package without choosing to cash in their leave. The government has made it optional to cash in leaves.

Also Raed:- UP Nrega Job Card List

Benefits under the LTC cash voucher plan are contingent upon the timely submission and settlement of all employee vouchers and bills for individuals scheduled to retire before March 31, 2020. If an employee chooses to utilize only the allotted LTC fare without using up any of their leave, they will receive reimbursement pro rata if their expenditure is three times less than the allotted amount. Note that this scheme does not cover premium payments for policies purchased before to October 12, 2020.

Key Information

| Name of the Scheme | LTC Cash Voucher Scheme 2023 |

| Started by | Finance Minister Nirmala sitharaman |

| Objective | supplying cash vouchers for purchases and travel |

| Beneficiary | Central Government employees |

| official website | – |

LTC Cash Voucher Scheme’s Goal

The idea was conceived by the Finance Minister, according to official sources, because the funds were initially intended to be used by government workers to make up for unpaid leaves lost due to the coronavirus outbreak. As the travel restrictions gradually lessen, the relevant government entities will be giving cash vouchers to all employees to cover their travel expenses. As long as the cash vouchers are utilized before March 31, 2021, when they expire, the employees are free to spend them for travel to any destination. The workers are free to travel to any destination, including their home.They can deduct their travel expenses from these certificates.

Benefits

The primary goal of the government’s LTC Voucher Scheme is to provide enough facilities for all Central Government employees, but it will also benefit the nation’s economy. The employees will receive reimbursement for their travel expenses, but they will still need to spend three times the trip voucher that the nation’s finance minister’s concerned authorities have granted them. If the employees receive travel coupons for 6000 LTC ticket, they must spend 18000 rupees on non-food products, with 12% GST applied. Both the nation’s economic flow and the people’s ability to produce more money for the economy would benefit from this.

Eligibility Criteria

While applying for the program, the applicant must adhere to the following eligibility requirements:

- The candidate needs to live in India.

- The Central Government must be the candidate’s employer.

- The candidate may also work for the state government.

The LTC Cash Voucher Scheme’s Features

- Launched to boost consumer market demand was the LTC cash voucher scheme.

- This program will improve the nation’s economic flow.

- To receive benefits under this system, the employee must spend three times the travel expense voucher.

- Only purchases of goods and services with a minimum 12% GST are eligible for this amount.

- The benefits of the LTC cash plan are contingent upon the production of a GST invoice.

- It is mandatory for the employees to make purchases using digital mode from the GST registered business.

- Employees who make purchases linked to food are not eligible to benefit from this arrangement.

- The government will issue the appropriate fare, which the employees must use by March 31, 2021.

- Employees in the public and private sectors are eligible to profit from the program.

- As a result, more GST will be received.

- The government anticipates that the LTC cash plan will generate an additional demand of Rs 1 lakh crore in the economy.

Also Read:- Svamitva Scheme

The LTC Cash Voucher Scheme requirements must be met

In order to be eligible for the LTC income tax benefits, workers need to:

- Buy goods and services from GST-registered vendors, including home appliances, two- and four-wheelers, and prepaid services like DTH recharge, internet payments, cell phone bills, and so on.

- For this purchase, we only accept digital payment methods; cash purchases are not refundable.

- When making purchases of goods and services, a minimum goods and services tax rate of 12% is necessary.

- limited to purchasing goods and services through March 31, 2023.

- The LTC benefit payments for a given year are only redeemable once.

- can purchase health and life insurance plans (such a simple term plan) and receive reimbursement for premiums paid up to the maximum amounts allowed.

Deemed LTC Fare

The value and quantity of LTC vouchers distributed to staff members are as follows:

| Employees | Vouchers Value |

| Employees who are entitled to business class of airfare | Rs 36000 |

| Employees who are entitled to an economy class of airfare | Rupees 20000 |

| Employees who are entitled to Rail fare of any class | Rupees 6000 |

Registration for the LTC Cash Voucher Scheme

Regarding the LTC Cash Voucher Scheme, there is currently no extra information accessible for registration. We will promptly update all material on this page upon announcement from the central government.

Should You Choose for it

- This is an optional prakalpa. Workers are able to select the standard LTC Cash Voucher Scheme year after year.

- They are eligible for the highest possible LTC.

- If an employee is allowed to travel with their family, they are eligible for an LTC/LTA exemption.

- Under this new strategy, they might be eligible to make an LTC claim during the coronavirus outbreak.

- It will be accessible by March 2023’s end.

- Tax savings will be available to those who receive LTC or LTA from their respective occupations.

- If employees want to get benefits under the LTC Cash Voucher Scheme plan, they have to spend three times as much LTA, which is the same as cashing in a leave of absence.

Also Read:- Samagra Kerla

Conclusion

Since the money was initially meant to be used by government employees to make up for time off that they had missed due to the coronavirus outbreak, officials suspect that the Finance Minister initiated this arrangement. Now that travel restrictions are easing, concerned government officials will provide LTC Cash Voucher Scheme to all employees as a trip expense.These cash vouchers are valid for travel to any location as long as the employee uses them before March 31, 2023, when they expire. Workers may go to any location, even their home. They can use these certificates to partially cover their travel expenses.

Suggested Link:- Mobile number Tracker Online

Saras