EPFO Higher Pension Scheme:- Section 6A of the EPF Act was used by the government to implement a pension plan in 1995. The Employees Pension Scheme, 1995 (EPS-95) stipulated that an employer must contribute 8.33% of their payroll to the pension plan. The highest monthly pension was limited by the EPS-95 at either Rs. 5,000 or Rs. 6,000. Hence, employers were required to pay 8.33% of the Rs. 5,000—which was eventually increased to Rs. 6,500—into the pension plan.

In March 1996, an amendment was made to Paragraph 11(3) of the EPS-95, allowing the employer and the employee to elect to contribute 8.33% of the real wage (above the Rs. 5,000 or Rs. 6,500 threshold) to the EPS. A salary that high would qualify for pension benefits. Nonetheless, the employees had six months from the EPFO to submit a joint option form to the EPS requesting increased pension contributions.

Effective January 9, 2014, the government made changes to the EPS-95 program. There is now an upper limit of Rs for a pensionable wage. 15, 000. Additionally omitted was the section in paragraph 11(3) that talks about the employer and employee exercising their right to choose to contribute EPS on a higher pay amount.

Also Read:- Agneepath Scheme Apply, Digitize India, Digitize India Platform, Work From Home Jobs

Contents

Higher pension contribution under EPFO Higher Pension Scheme

Following the 2014 change, there were problems with increased salary pension contributions. Numerous workers acknowledged that they were aware of the joint option to execute pension contributions based on increased compensation. The joint option that numerous employees filed was denied by the EPFO. Without filing a joint option, employers contributed 8.33% of employees’ actual earnings towards pensions; nonetheless, the pension computation used Rs. 15,000 as the pensionable pay.

In an effort to obtain larger pensions based on their actual salary contributions, some employees brought cases to the High Courts. This case reached the Supreme Court. The following summarises the Supreme Court’s ruling:

| Status of Employee | Exercise of joint option | Eligibility to claim 8.33% pension contribution on a higher salary | Mode of higher pension claim |

| Employees in service as on 01/09/2014 | Exercised joint option and rejected by the EPFO | Yes | By filing a higher pension claim application |

| Employees in service as of 01/09/2014 | Not exercised joint option but contributing to EPS above the cap of Rs.5,000/Rs,6,500 | Yes | By exercising the joint option |

| Employees retired before 01/09/2014 | Exercised joint option and rejected by the EPFO | Yes | By filing a higher pension claim application |

| Employees retired before 01/09/2014 | Employees in service as of 01/09/2014 | No | Not applicable |

A Supreme Court verdict states that employees who were a part of the Employee Provident Fund (EPF) before to January 9, 2014, but have not yet done so by March 5, 2023, may exercise the Joint Option. The EPFO once more extended the deadline to July 11, 2023. These workers will have a higher EPS contribution computed as of the joining date.

For example:

- The EPF accepted Mr. “X” as a member in 1998.

- Neither of them has exercised the joint option.

- In 2015, his pay rose to Rs. fifty thousand.

- His company makes an EPF contribution of Rs. 6,000, or 12% of his base pay.

- The EPS will receive Rs. 1,250 from the employer’s payment, or 8.33% of the statutory wage ceiling of Rs. 15,,000.

- The EPF will receive the remaining Rs. 4,750 (or Rs. 6,000 – Rs. 1,250).

- According to the Supreme Court’s ruling, he exercises the joint option by July 11, 2023, as the EPS contribution exceeds the statutory pay maximum of Rs. 6,500.

- His employer will make an EPF contribution of Rs. 1,835 (Rs. 6,000 – Rs. 4,165) and Rs. 4,165 (i.e., 8.33% of Rs. 50,000, his real pay) upon the submission of the joint option.

- The EPFO will transfer the 8.33% monthly EPS amount which is the gap between the real salary and the EPS from the EPF to the EPS.

In these situations, the EPFO will transfer the difference from the PF account to the EPS account and go back to the joining date or 01/11/1995, whichever comes first. The higher pension contributions will, however, reduce the employee’s retirement benefit from the EPF lumpsum corpus.

Also Read:-Mahila Samman Saving Scheme

EPFO Higher Pension Scheme Higher pension eligibility

In December 2022, EPFO published a circular outlining the requirements for eligibility and the application procedure for requesting a higher pension. The requirements for qualifying for a larger pension are as follows:

- Prior to January 9, 2014, the staff members retired.

- While they were members of EPS-95, the employees exercised their joint option in accordance with EPS-95 para. 11(3).

- If an employee’s salary exceeded the Rs. 5,000 or Rs. 6,500 wage ceiling, both the company and the employee contributed EPS.

- The EPFO rejected the option’s exercise.

- However, for workers who joined the EPF before January 9, 2014, but continued to work or retire after that date, the EPFO circular did not offer a greater pension option. These workers were also qualified to receive a larger pension, according to the ruling of the Supreme Court.

- Therefore, in February, the EPFO released a second circular outlining stricter pension eligibility standards for workers who remain in service or retire after 2014. To be eligible for a bigger pension, a joint option filing must satisfy the following conditions:

- Employees who were members prior to January 9, 2014, remained members following that date.

- Employers and employees made contributions to EPS on salaries above the Rs. 5,000 or Rs. 6,500 salary ceiling.

- Employers and employees who belonged to EPS-95 did not exercise their joint option under the 2014 revision and repealed paragraph 11(3) of the EPS.

- Employees who executed their joint options under the now-deleted paragraph 11(3) of the EPS and were members of EPS-95, but who did not file fresh joint options following the 2014 change, are not, however, qualified to receive a higher pension. Regardless of their actual pay, these employees will contribute 8.33% of their maximum salary of Rs. 15,000 towards EPS.

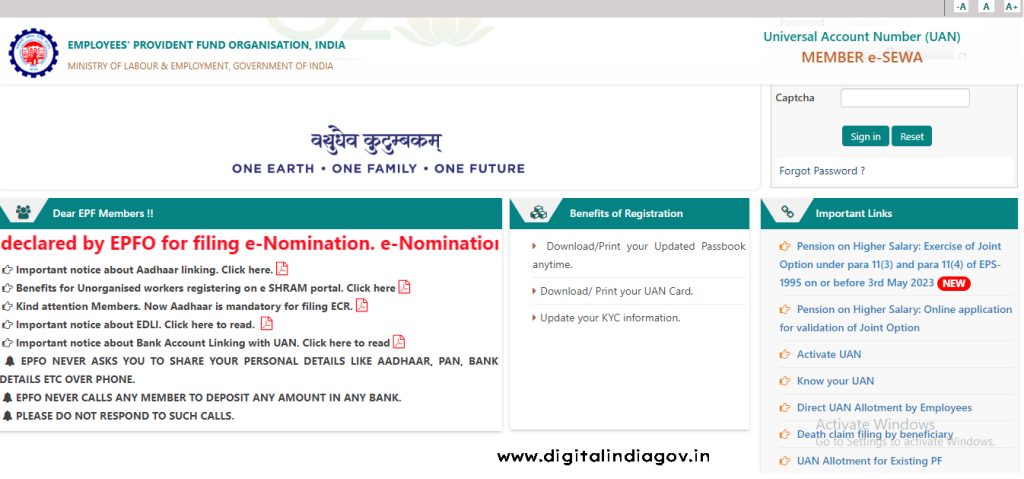

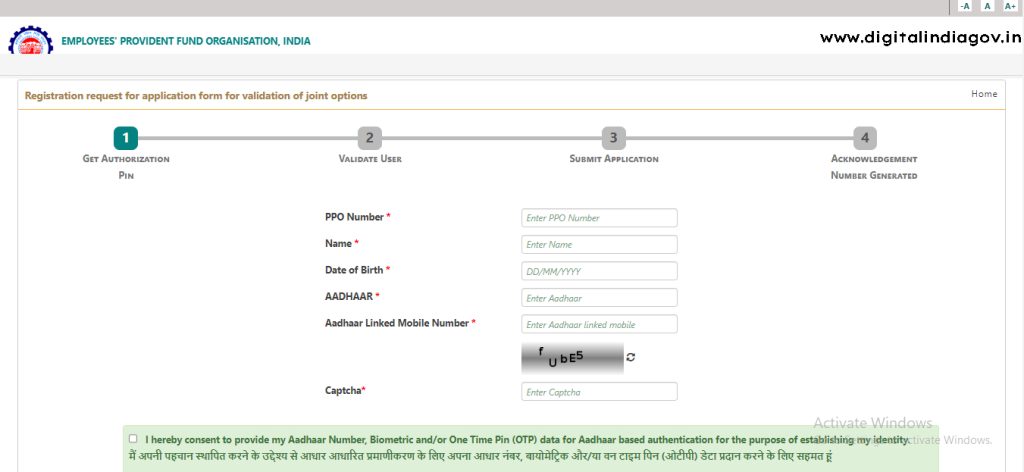

How to apply for a joint option online pension form in the EPFO Higher Pension Scheme?

Here’s how employees who retired before 2014 can apply for a higher pension amount:

- The EPFO Unified Member site is the first place that employees must go.

- Step 2 entails selecting the “Pension on Higher Salary: Online application for validation of Joint Option.”

- Step 3: Fill out all the information on the form to finish it.

The EPFO will digitally record each application and provide the applicant with a receipt number. The relevant employers will receive the applications, and before processing them further, they will use an electronic signature (e-signature) to validate them. After reviewing the case, the APFC/RPFC-II will notify the applicants by phone, email, or SMS of the higher pension decision.

The field officers will review the application. The wage information supplied by the employers will be compared with the information obtained from the field offices if the form is completed in its whole. Following the information matching between the employers and field officers, the dues are computed, and RPFC-II/RPFC-I/APFC gives an order for the dues to be transferred or deposited. When there is a discrepancy, the APFC/RPFC-II will notify the pensioner and the employer, and they will have one month to make the necessary corrections.

Before the form is rejected, the employer will provide the applicant an opportunity to address any issues or submit further supporting paperwork if the application is denied. The seniors will be notified of this change, which will be available for a month.

EPFO Higher Pension Scheme guidelines for higher pension

- The application for a greater pension claim or joint option should contain a disclaimer or declaration.

- In the joint option/application form, an employee must expressly consent to a share adjustment from PF to EPS and a re-deposit of the appropriate amount.

- An employee must provide a trustee’s undertaking for the share transfer of funds from the exempted PF trust to the EPFO pension fund. The endeavor will remain as long as the necessary interest and contribution are submitted by the deadline and within the designated period.

- Employer contribution share refunds for non-exempted establishment employees are deposited using the interest rate outlined in EPF Scheme, 1952, paragraph 60.

- Attached to the application for a greater pension claim is the following documentation:

- Proof of joint option, as confirmed by the employer, submitted in accordance with EPF plan paragraph 26(6).

- Employer-verified proof of joint option filed in accordance with paragraph 11(3).

- Evidence of EPS contributions made to the PF account beyond the current salary cap of Rs. 5,000 or Rs. 6,500.

- written rejection of the request or refund from EPFO or APFC.

- Together with the joint option application, the following paperwork needs to be submitted:

- Evidence of EPS contributions made to the PF account beyond the current salary cap of Rs. 5,000 or Rs. 6,500.

- Proof of joint option, as confirmed by the employer, submitted in accordance with EPF plan paragraph 26(6).

- The EPFO will issue additional circulars regarding the technique of deposit and pension calculation.

- When an employee has a grievance regarding receiving a higher pension, they can file a complaint on EPFiGMS after submitting an application and paying any outstanding contributions.

Also Read:- Anyror Gujarat Bhulekh

EPFO Higher Pension Scheme higher pension calculation formula

Higher pension calculations for those who retired prior to 2014:

In the year before leaving EPFO, the average monthly pay earned during the contributed term of service is used to compute the pension amount.

Higher pension calculations for those who retired after 2014:

The pension amount is calculated using the average monthly salary earned over the contributed period of service in the sixty months prior to quitting EPFO.

As of right now, the EPS program uses the following formula to determine pensions:

(Average pay over 60 months x length of service) / 70

FAQ’s

Q. How can I increase my EPF pension?

Ans- To receive a higher pension, qualified workers should apply for a higher pension through a joint claim or directly to the relevant regional PF commissioners.

Q. How is a greater pension for EPF calculated?

Ans- The following calculation can be used to determine an EPF higher pension: (Pensionable salary X pensionable service)/70 equals the monthly pension amount. Soon, the EPF will publish a circular outlining the methodology used to determine larger pensions.

Suggested Link:- Our Jharkhand

@PAY