EPF Pension Scheme, SC removes the Rs. 15,000 restriction on additional contributions and extends the deadline for enrolling in the EPF pension plan. We are giving information here regarding EPFO, eligibility, and everything else.

Contents

EPFO Pension Scheme 2024

The Employees Pension Scheme of 1995 is another name for the EPF pension plan, which was introduced by the government in that year. Both new and current EPF members are included. If a member wishes to withdraw pension funds, the EPS pension plan has certain conditions. The Employees Provident Fund Organisation (EPFO) introduced the Employee Provident Savings Plan (EPS) to provide social security. This plan provides pension benefits to workers in the organised sector who retire at age 58. This scheme’s benefit is only available to employees who have rendered at least ten years of continuous or unbroken service. The EPS pension was kept for both newly hired and current employees starting in 1995.

Also Read: Aasara Pension Scheme, digitizeindiagovin.com, Typingspeedtestonline, Nebsit Council

EPFO Pension Scheme Latest News

EPFO Pension Scheme Latest News: The Supreme Court has stated that, because the time restriction is not explicitly stated, employees who are eligible to join the pension scheme but were unable to do so because they did not exercise their option within the allotted period should be granted another chance. considering the rulings of the top courts. The Employees’ Pension (Amendment) Scheme, 2014’s provisions were affirmed as lawful and valid by the Supreme Court on Friday. Nonetheless, the 2014 scheme’s demand that employees pay an extra 1.16 per cent contribution on salaries beyond Rs 15,000 was overturned by the Supreme Court.

Key Features of the EPF Pension Scheme

The EPF Pension Plan is advantageous for employees due to a number of significant elements, including:

- Pension Payment Each Month: After retirement, qualified workers are given a pension that provides a consistent source of income each month.

- Employer’s Contribution: A portion of the employee’s pay is contributed by the employer to the pension plan, increasing the pension amount.

- Benefits of Survivorship: Should the employee pass away, the pension payments would be payable to the spouse or nominee, providing the family with financial stability.

- Transportable Advantages: When an employee changes jobs, they can transfer their EPF accounts to continue saving for retirement.

- Government Support: Employee investments in the EPF Pension Scheme are safe since the government backs it.

Eligibility Criteria for EPF Pension Scheme

In order to be eligible for the EPF Pension Plan, workers need to fulfil certain requirements:

- Minimum Age Requirement: To be eligible to receive pension benefits, employees must be 58 years old.

- Minimum Time Spent in Service: Pension benefits are only available to those who have worked for the company for at least ten years.

- Participation in EPF: The pension plan is only available to workers who are members of the Employees’ Provident Fund.

Also Read: 12 Rs Insurance Scheme, Mobilenumbertrackeronline, indnewsupdates.com, ssorajasthanidlogin.com,

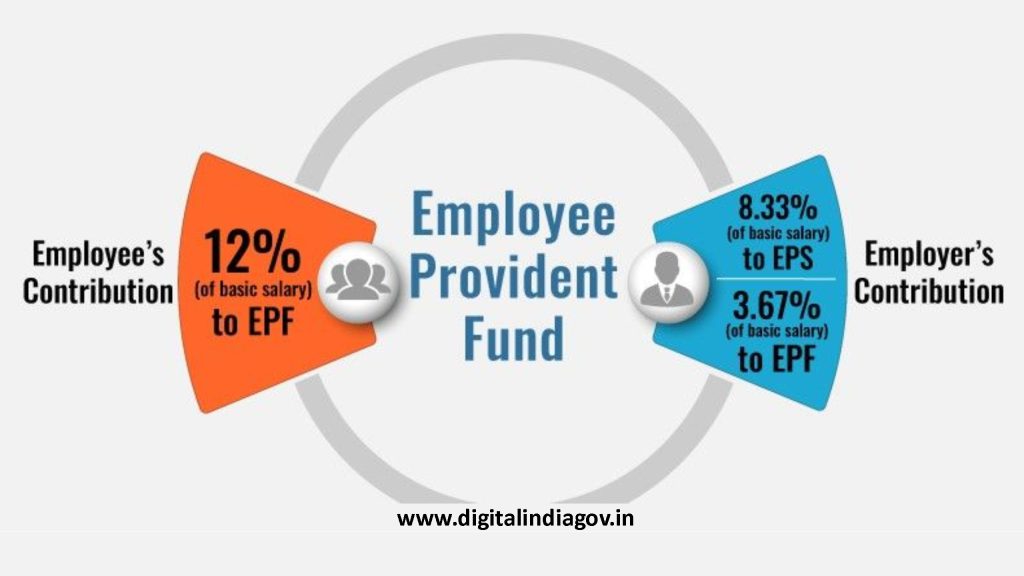

Contribution Structure of the EPF Pension Scheme

Employee comprehension of the contribution structure is crucial:

- Contribution of Employees: The EPF deducts a percentage of the employee’s base pay in order to fund the pension plan.

- Employer Grant: An additional portion of the employee’s pay, which goes into the pension fund, is contributed by the employer.

- The contribution of the government: In order to guarantee the fund’s development and sustainability, the government also makes contributions to the program.

How to Apply for the EPF Pension Scheme?

The procedure for applying to the EPF Pension Plan is simple:

- Enrolment in Membership: At the moment of hire, workers must register for the EPF program through their employer.

- Updating and Correcting the Service Record Make sure that the employment facts are up to date and accurate.

- Pension Application Procedure: When an employee reaches retirement age, they have to send the EPFO an application for pension along with the necessary paperwork.

Benefits of the EPF Pension Scheme

The EPF Pension Plan has a lot of benefits.

- Monetary stability: The greatest advantage is a steady stream of income that helps employees continue to live comfortably after retirement.

- Security of the Family and Health: If an employee passes away, their relatives will be financially secure thanks to the survivorship benefits.

- Tax Advantages: Section 80C of the Income Tax Act allows contributions to the Employee Provident Fund (EPF) to be tax deductible, providing further financial advantages.

EPF Pension Calculation: How is the Pension Amount Determined?

Employees must comprehend how the pension amount is determined.

- The Pension Calculation Formula: The average pay of the employee and the number of years of service are used to calculate the pension amount.

- Pension Limitations: Minimum and Maximum Employees should be informed that there are minimum and maximum pension limits.

Challenges and Issues with the EPF Pension Scheme

The EPF Pension Plan has advantages, but it also has drawbacks.

- Consciousness and comprehension: Underutilisation results from a lack of awareness among employees regarding the features and benefits of the scheme.

- Pension Processing Delays: Administrative problems cause delays for some employees when they get their pension.

- Not Enough Contributions: Workers may not have made enough EPF contributions, which would result in insufficient pension payments upon retirement.

Recent Changes and Updates to the EPF Pension Scheme

It’s critical to keep up with recent developments:

- Updates to Policies: The EPF Pension Scheme’s policies are updated by the government on a regular basis, which has an impact on contributions and benefits.

- Technological Progress: The use of technology has simplified the application and processing procedures for pensions.

Also Read: ADIP Scheme, shaladarpanportalgov.com, yojanaforall.com, Onlinereferjobs

Conclusion

For Indian workers, the EPF Pension Scheme is a crucial part of their financial planning since it offers stability and comfort in old age. Through comprehension of the program’s attributes, qualifying standards, and enrolment procedure, staff members can make knowledgeable choices to safeguard their prospects. The support of the government further guarantees that this program will continue to be a dependable source of income for a large number of people.

Faq’s

Q. Who oversees the EPF Pension Plan, and what is it?

Ans: An Indian retirement savings plan administered by the Employees’ Provident Fund Organisation (EPFO) is called the Employees’ Pension Scheme (EPS) or EPF Pension Plan. After retirement, it offers a monthly pension to workers, guaranteeing their financial stability.

Q. In the EPF Pension Plan, how is the pension amount determined?

Ans: The employee’s average pay during the last five years of employment and the total number of years worked are used to determine the pension amount. The calculation formula is as follows: Pension = Pensionable Salary x Pensionable Service / 70

Pension is equal to (Pensionable Service x Pensionable Salary) / 70. The maximum pension amount is set by the scheme’s rules, and the pensionable wage is capped.

Q. Can I take a pre-retirement EPF pension withdrawal?

Ans: It is not possible to withdraw the pension amount before retirement. However, in some situations, such as in cases of unemployment or serious illness, employees may withdraw their whole EPF balance.

Q. If I move employment, what happens to my EPF pension?

Ans: You can move your EPS and EPF accounts to a new employer if you change jobs. The information of pensionable service and remuneration will be adjusted correspondingly, guaranteeing benefits continuity.

@PAY