SBI Fixed Deposit Monthly Income Scheme, A specially created savings plan called the SBI set Deposit Monthly Income Scheme (MIS) is available to people who wish to obtain a set monthly income from interest payments. The Monthly Interest System (MIS) enables depositors to receive monthly interest, in contrast to standard fixed deposits that pay interest annually or at maturity. This feature makes the MIS a dependable source of income, particularly for retirees and those wishing to supplement their income.

Contents

How Does the SBI Fixed Deposit Monthly Income Scheme Work?

The SBI MIS functions similarly to other fixed deposits (FDs), with the payout structure being the primary distinction. You receive interest at a set rate on a lump sum investment you make in the scheme. The bank distributes this interest on a monthly basis rather than collecting it all at maturity. This is how it operates:

- Deposit a Lump Sum: Make a one-time investment in a fixed-rate note (FD).

- Monthly Payouts: You receive monthly interest, which functions as a regular source of income, based on the interest rate.

- Tenure: It can last up to ten years, with a minimum of twelve months.

Also Read: Agniveer Scheme Salary, shaladarpanportalgov.com, yojanaforall.com, Onlinereferjobs

Who Can Benefit from the SBI Fixed Deposit Monthly Income Scheme?

This plan is perfect for:

- Retirees: People who, upon retirement, are seeking a steady source of income.

- People Looking for Stable Income: Those who are looking for a steady income that doesn’t involve taking any risks.

- Those who value security and don’t want to risk their assets on volatile markets are known as conservative investors.

Key Features of the SBI FDMIS

The following are some of the main characteristics that draw investors to the SBI MIS:

- Regular Income: Based on the size of your FD, guaranteed monthly payouts.

- Safe Investment: It is regarded as a safe investment because it is provided by a bank that is supported by the government, such as SBI.

- Flexible term: Select a term from 12 months to 10 years that best fits your budget.

- Early Withdrawal: Although early withdrawal is permitted, there can be consequences.

- Nomination Facility: In the event of an unanticipated circumstance, you can choose a beneficiary to receive the proceeds of the FD.

Interest Rates of SBI Fixed Deposit Monthly Income Scheme

The SBI Fixed Deposit Monthly Income Scheme offers interest rates that are comparable to those of regular fixed deposits. On the other hand, the rate changes according to the deposit’s tenure. The interest rate rises with the length of the tenure. Here are some things to think about:

- Rates for the General Public: SBI provides competitive interest rates for longer terms, with the potential to reach 7% (as of 2024).

- Senior persons: This is a great alternative for retirees because senior persons receive an extra 0.50% interest over ordinary rates.

- Monthly Payouts: Although the interest is computed monthly, the frequent payout may result in an effective annual rate that is marginally lower than if you had chosen yearly interest.

Eligibility Criteria for SBI Fixed Deposit Monthly Income Scheme

You have to fulfil the following requirements in order to be qualified for the SBI FDMIS:

- Individual Investors: The initiative is open to all citizens of India.

- NRIs: As long as they possess an NRE or NRO account, non-resident Indians are also qualified.

- Joint Accounts: Spouses, family members, and partners may open joint accounts.

- Minimum Deposit: ₹1,000 is the minimum deposit amount, though this could fluctuate somewhat between SBI branches.

How to Apply for SBI Fixed Deposit Monthly Income Scheme?

It’s simple to invest in the SBI FDMIS using both offline and online ways. Here’s a detailed how-to:

Offline Method:

- Visit the Closest SBI Branch: Bring proper identification and proof of address to the SBI branch that is closest to you.

- Complete the Application Form: Obtain the MIS application form and complete it with the required information.

- Send in Documents: Send in the necessary KYC paperwork, such as your passport, Aadhaar, or PAN card.

- Amount of Deposit: Enter the total amount you want to invest in the scheme as a lump sum.

Also Read: Aasara Pension Scheme, Mobilenumbertrackeronline, indnewsupdates.com, ssorajasthanidlogin.com

Online Method:

- Open SBI Net Banking and log in: Using your login information, access your SBI online banking account.

- Choose the Fixed Deposit option. Select the Monthly Income Scheme under the Fixed Deposit section.

- Put Deposit Information Here: Give the tenure, payout option, and deposit amount.

- Send in: Your deposit will be established and you will begin receiving monthly interest distributions as soon as you review and confirm.

Tax Implications of SBI Fixed Deposit Monthly Income Scheme

The Income Tax Act imposes taxes on the SBI Fixed Deposit Monthly Income Scheme. Here are some things to think about:

- Tax Deducted at Source, or TDS is withheld whenever interest income in a fiscal year surpasses ₹40,000 (₹50,000 for senior citizens).

- Taxable Income: Your overall income is increased by the interest you earn from the MIS, which is then taxed based on your income tax slab.

- Form 15G/15H: You can submit Form 15G or 15H to stop TDS from being deducted if your total income is less than the taxable limit.

Premature Withdrawal Rules

Flexibility is provided by the SBI Fixed Deposit Monthly Income Scheme, although there are additional restrictions on early withdrawals:

- Lock-in Time: You can remove the deposit after the minimum 6-month lock-in term, however there may be consequences.

- Penalties and Charges: Depending on the term and the amount invested, early withdrawal penalties could range from 0.50% to 1% of the interest rate.

- Early withdrawals are free of interest. There will be no interest if the deposit is withdrawn before the six-month period.

Benefits of SBI Fixed Deposit Monthly Income Scheme for Senior Citizens

When they invest in the SBI MIS, senior citizens can gain the following additional advantages:

- Higher Interest Rates: Better returns are guaranteed for senior folks, who also receive an extra 0.50% interest.

- Dependable Income Source: By providing retirees with a steady income, the plan makes it simpler for them to budget their monthly costs.

- Safe Investment: Seniors searching for a reliable investment have a risk-free choice in SBI’s MIS.

SBI Fixed Deposit Monthly Income Scheme vs. Other Investment Options

How does the SBI FDMIS stack up against other investment options that provide consistent income?

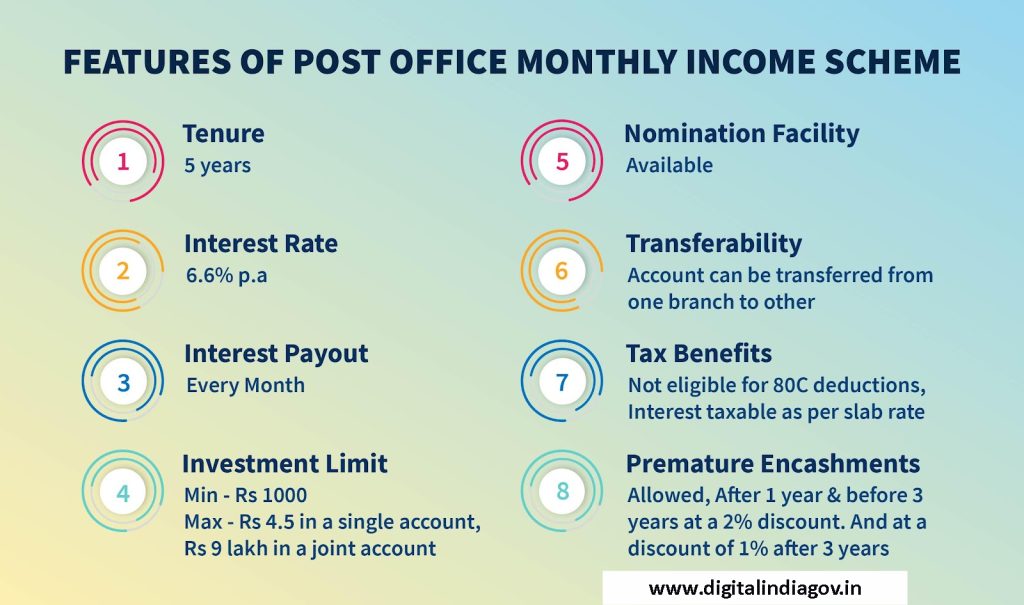

POMIS (Post Office Monthly Income Scheme) versus SBI MIS

- Safety: Both are secure investments supported by the public sector or the government.

- Returns: SBI MIS provides competitive interest rates; but, for shorter terms, the Post Office MIS might give slightly better rates.

SBI MIS vs. Mutual Funds

- Risk: While SBI MIS has no risk, mutual funds have the potential to yield better returns but at the expense of more dangers.

- Returns: SBI MIS provides guaranteed monthly income, but mutual funds have the possibility for larger returns.

SBI MIS vs. Annuity Plans

- Payouts: Annuity plans, like SBI MIS, also offer consistent income, although they could also have more fees and less flexibility.

Also Read: 12 Rs Insurance Scheme, digitizeindiagovin.com, Typingspeedtestonline, Nebsit Council

Conclusion

For those looking to invest safely and reliably without taking unnecessary risks, the SBI Fixed Deposit Monthly Income Scheme offers a consistent monthly income stream. This program appeals especially to retirees and conservative investors who choose stable returns over high-risk, high-return ventures. It offers variable tenures, attractive interest rates, and the support of a reputable bank.

Faq’s

Q. What is the Monthly Income Scheme for Fixed Deposits at SBI?

Ans: Rather of having to wait for the fixed deposit to mature, investors can get regular monthly interest payouts under the SBI Fixed Deposit Monthly Income Scheme. It is intended for anyone looking for a reliable source of monthly income.

Q. What is the SBI Fixed Deposit Monthly Income Scheme’s minimum deposit requirement?

Ans: A ₹1,000 minimum deposit is needed. However, this sum can change a little based on the terms of the scheme or the particular SBI branch.

Q. What is the SBI Fixed Deposit Monthly Income Scheme’s duration range?

Ans: The SBI MIS has a duration that varies from 12 months to 10 years, allowing investors to select a term that best fits their needs.

Q. Are higher interest rates available to senior citizens?

Ans: Yes, seniors are entitled to an interest rate increase of 0.50% over the base rates, which increases the scheme’s profitability for retirees seeking a reliable source of income.

Q. Is it permissible to take early withdrawals from the SBI Fixed Deposit Monthly Income Scheme?

Ans: Yes, you are permitted to withdraw early after the six-month lock-in term. Premature withdrawals, however, could incur penalties that lower the interest received.

@PAY